- Simple accounting software with chart of accounts how to#

- Simple accounting software with chart of accounts professional#

- Simple accounting software with chart of accounts free#

If she had already spent $2,000 on plaster up to that point, the adjusting entry would look like this: Account She would then make an adjusting entry to move all of the plaster expenses she already had recorded in the “Lab Supplies” expenses account into the new “Plaster” expenses account. To do this, she would first add the new account-“Plaster”-to the chart of accounts. Instead of recording it in the “Lab Supplies” expenses account, Doris might decide to create a new account for the plaster. Let’s say that in the middle of the year Doris realizes her orthodontics business is spending a lot more money on plaster, because her clumsy intern keeps getting the water to powder ratio wrong when mixing it. If you delete an account in the middle of the year, it might mess up your books.

Simple accounting software with chart of accounts free#

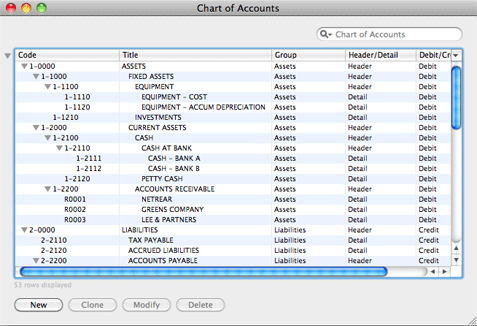

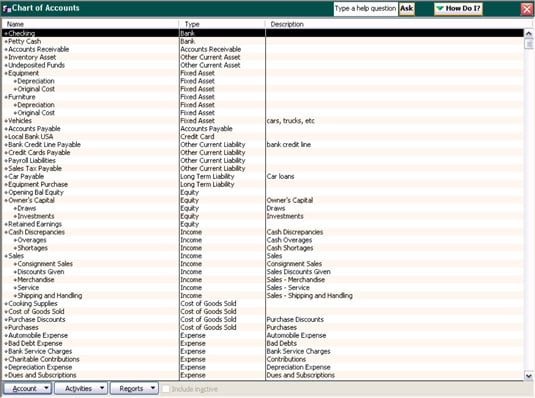

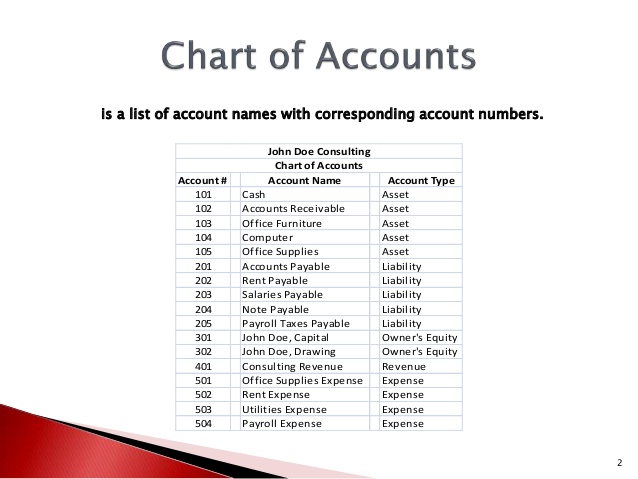

The rules for making tweaks to your chart of accounts are simple: feel free to add accounts at any time of the year, but wait until the end of the year to delete old accounts. In addition, codes are introduced and defined. The way that the balance sheet and income statement accounts interact with each other is complex, but one general rule to remember is this: revenues increase your company’s equity and asset accounts, while expenses decrease your assets and equity. The chart of accounts tutorial and course defines, explains, and discusses what the chart of accounts is, how its organized by major account types, balance sheet and income statement accounts, and its purpose. Revenue accounts keep track of any income your business brings in from the sale of goods, services or rent.Įxpense accounts are all of the money and resources you spend in the process of generating revenues, i.e. We use the income statement accounts to generate the other major kind of financial statement: the income statement. They basically measure how valuable the company is to its owner or shareholders. They represent what’s left of the business after you subtract all your company’s liabilities from its assets. “Unearned revenues” are another kind of liability account-usually cash payments that your company has received before services are delivered.Įquity accounts are a little more abstract.

Simple accounting software with chart of accounts how to#

How to create flowcharts for an accounting information system. Liability accounts usually have the word “payable” in their name- accounts payable, wages payable, invoices payable. Accounting flowchart is a system of processes to represent accounting system of an organization.

Liability accounts are a record of all the debts your company owes. They can be physical assets like land, equipment and cash, or intangible things like patents, trademarks and software.

Simple accounting software with chart of accounts professional#

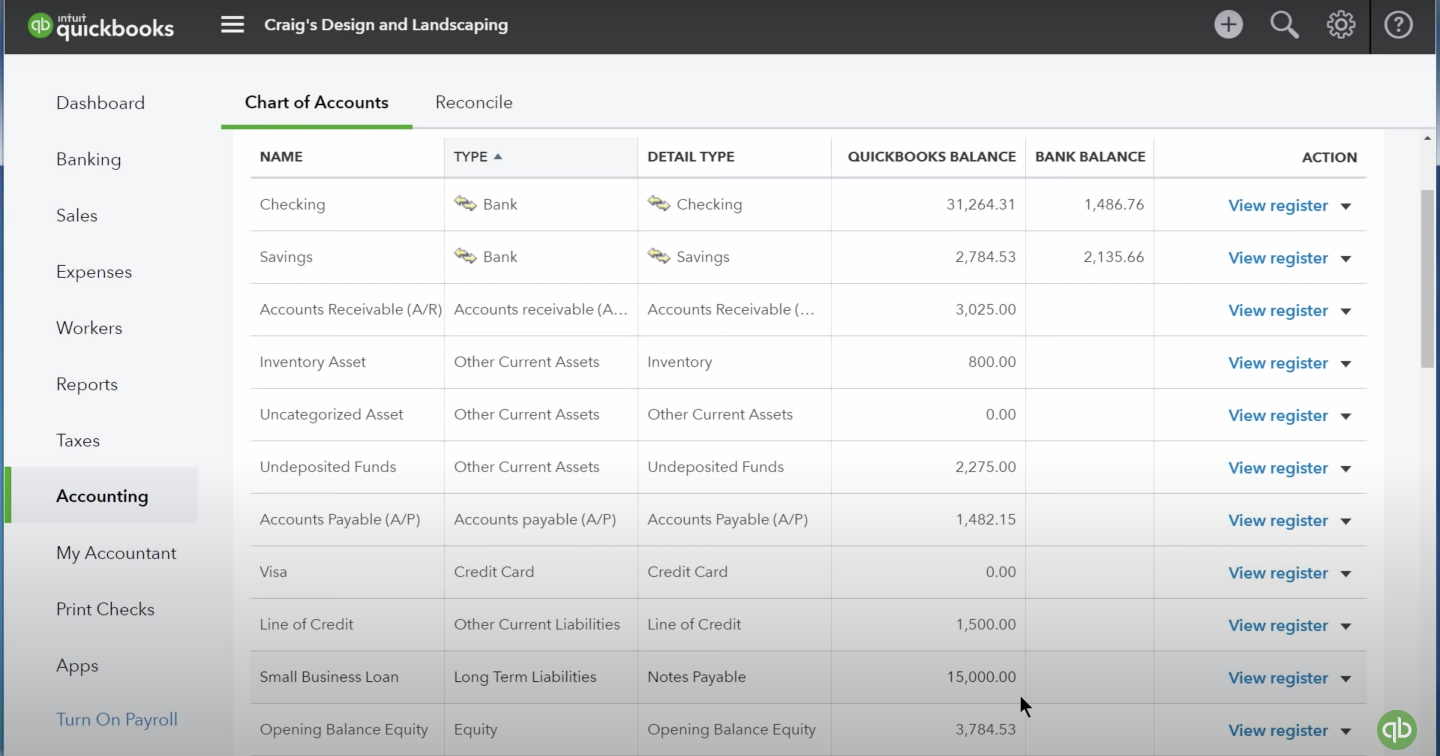

It also allows you to create quotes and estimates that can easily become professional invoices. The free version of this accounting software allows for unlimited automated receipt entries, 10 different companies on one account, and email support. From creating and tracking invoices to monitoring cash flow to recording transactions, it offers impeccable features and accuracy. There are three kinds of balance sheet accounts:Īsset accounts record any resources your company owns that provide value to your company. The free accounting software SlickPie is also worth looking into for your small business finances. Accounting software by Sage provides an easy to use, all-in-one system that can organize your business accounts while centralizing your operations. We call these the “balance sheet” accounts because we need them to create a balance sheet for your business, which is one of the most commonly used financial statements. This one is for a fictional business: Doris Orthodontics.Īs you can see on the right, there are different financial statements that each account corresponds to: the balance sheet and the income statement.

In turn, you will become financially aware and build a better business.Here’s a sample chart of accounts list. As you begin to organize better each account associated with your restaurant, you will gain a greater short- and long-term understanding of your business. Think about the Chart of Accounts as the plate you create the masterpiece of an amazing dish, without the basic blank canvas of the plate (or for this matter the chart of accounts), no matter what you put on top will surely fall to the ground (and similarly your business will fail). Here is where a Chart of Accounts comes into play - an organized system that will help you better understand if your restaurant is profitable, how it makes money, and if you are losing money, and exactly where your dollars went. Although it takes a lot more than great food and service for a restaurant to be successful, there’s nothing more vital to the establishment’s long-term success than effective bookkeeping and accounting.

0 kommentar(er)

0 kommentar(er)